This article is an English translation of this article in Japanese for those who need to follow the Japanese taxation.

| The tax return filing season has started. This is a step-by-step guide that explains how to create a tax return for cryptocurrency transactions, which is a topic that we frequently receive questions on. |

Generally, profits from bitcoin and other cryptocurrency trading are classified as miscellaneous income. However, the details of the tax return may vary from person to person, depending on other incomes, deductions and other factors.

In this guide, we will go through the process of creating a tax return for the following scenario:

✔ A typical company employee who receives a salary from one company. He/she uses Cryptact to calculate the realized pnl for his/her cryptocurrency transactions.

✔ Other information required for the tax return is obtained from the Withholding Tax Slip (源泉徴収票: Gensen Choshu Slip in Japanese) received from his/her employer.

For year 2023, the tax return submission period is from Friday February 16th, 2024 to March 15th, 2024.

You can create your tax return by accessing "Final Tax Return Preparation Corner (確定申告書等作成コーナー)" on the National Tax Agency website.

Access "Final Tax Return Preparation Corner (確定申告書等作成コーナー)"

Contents:

Step 1. Check whether you need to file a tax return or not

Step 3. Enter basic information

Step 4. Declare income from cryptocurrency trading

Step 8. Enter personal information

Step 1. Check whether you need to file a tax return or not

You need to file a tax return if your annual income from cryptocurrency trading exceeds 200,000 JPY.

However, even if it does not exceed 200,000 JPY, you may still need to file a tax return for other reasons (e.g. applying for a medical expense deduction, hometown tax deduction, etc).

Calculating the pnl for cryptocurrency trading is complex, and doing this by yourself can be difficult. With "Cryptact", you simply upload your transaction histories downloaded from your exchanges, and the profit and loss (PNL) calculation is done automatically.

→ Start using Cryptact for free from here

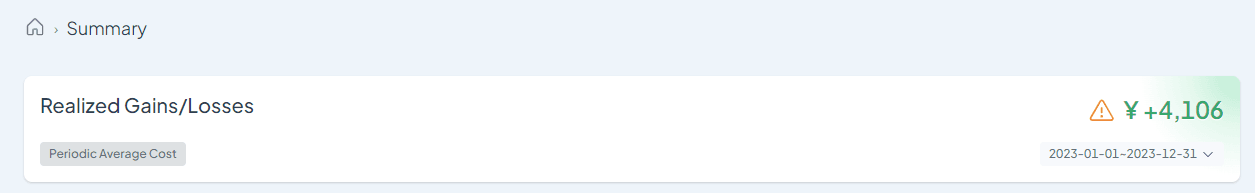

■How to check the profit and loss (PNL) in Cryptact

Log in to Cryptact, and go to the "Legder" tab.

The amount displayed as the "Realized Gains/Losses" is the automatically calculated realized PNL. If you are creating a tax return for year 2023 (which should be the majority), please make sure 2023 is displayed on the right. If you are creating a tax return for an earlier year, please check the realized PNL for the relevant year.

Please also check that the cost basis method displayed underneath is consistent with what you expect. For an individual, the "Periodic Average Cost" method is applied by default. If you want to use the "Average Cost" method, you need to submit a change request to the tax office.

The amount displayed as the "Realized Gains/Losses" is the profit from cryptorcurrency trading if it is positive. You need to deduct the necessary expenses from this for the income amount to be used to determine whether you need to create a tax return or not.

If you have any necessary expenses that are not accounted for in Cryptact, you can deduct them from your realized PNL. For details on what can be considered a necessary expense, please refer to National Tax Agency's FAQ "2-3 Necessary Expenses in Crypto Assets/暗号資産の必要経費 (Japanese only)".

Even if the realized gains/losses displayed on Cryptact exceeds 200,000 JPY, if the amount of income after deducting necessary expenses is below 200,000 JPY, there is no need to create a tax return solely based on cryptocurrency transactions.

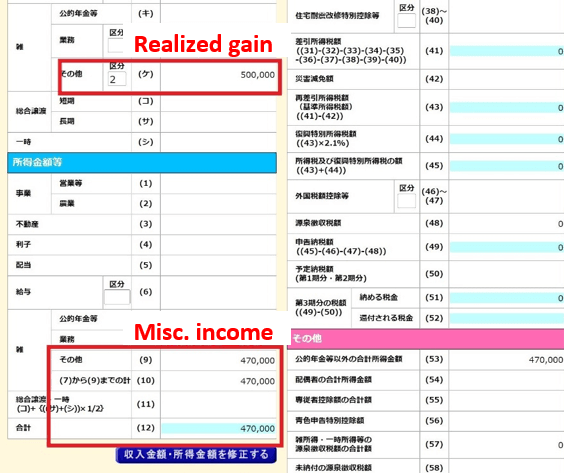

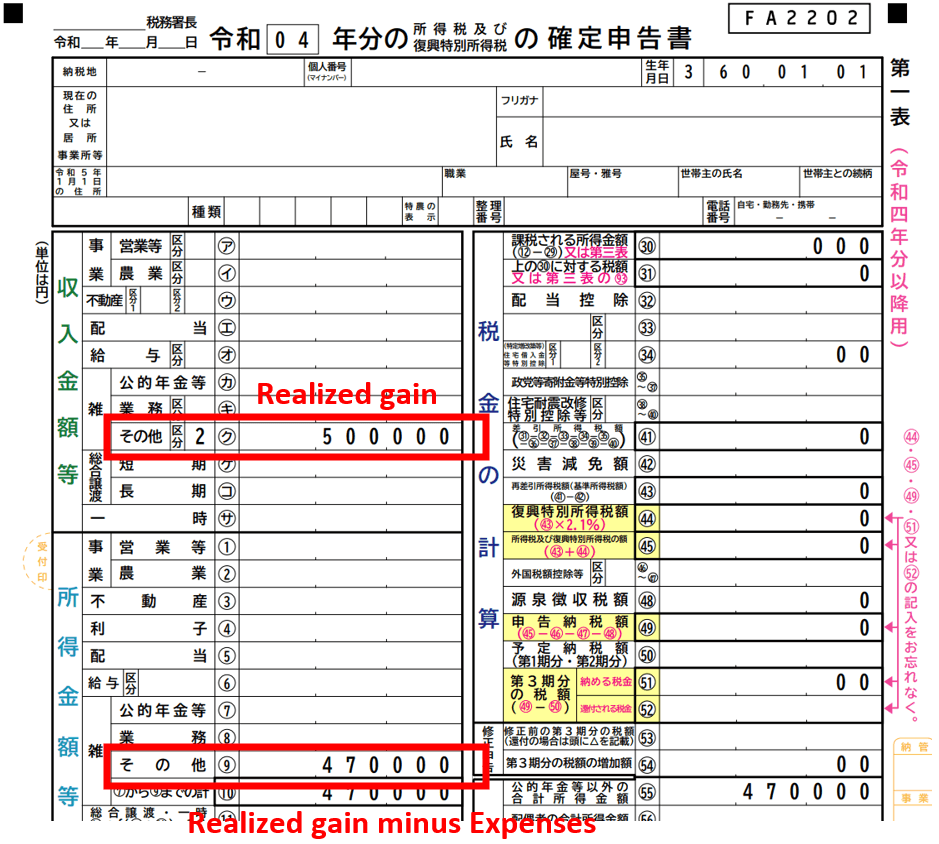

In this guide, we will create a tax return for a scenario where the realized PNL is 500,000 JPY and the necessary expense is 30,000 JPY.

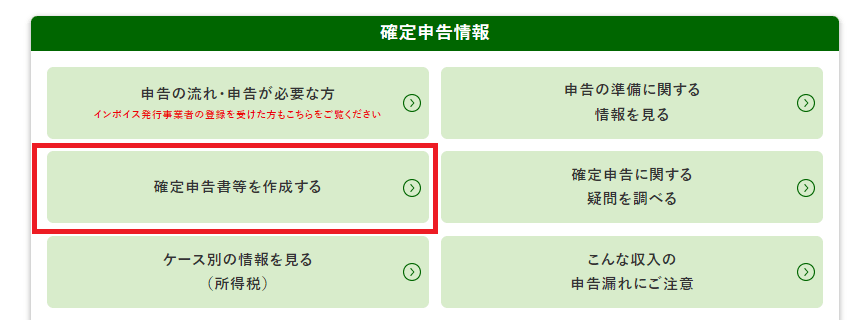

Step 2. Access National Tax Agency's "Special Feature on Final Tax Return/確定申告特集 (Japanese only)" page

If you need to file a tax return, e.g. the amount of income from cryptocurrency trading in Step 1 exceeds 200,000 JPY, go to the National Tax Agency's website. Please have your Withholding Tax Slip handy as you will need it while creating a tax return.

■ National Tax Agency's "Special Feature on Final Tax Return/確定申告特集"

National Tax Agency - Special Feature on Final Tax Return 2023/令和5年分 確定申告特集 (Japanese only)

Click the above link to access NTA's homepage. Click "Prepare Tax Return form/確定申告書を作成する (Japanese only)" in the middle of the screen.

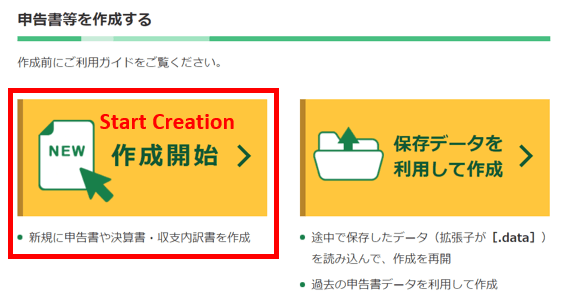

After the "Final Tax Return Preparation Corner/確定申告書等作成コーナー" page is loaded, click "Start Creation/作成開始".

* There is also a function to save the tax return that you are currently working on. To work on the tax return you previously saved, click "Create from Saved Data/保存データを利用して作成".

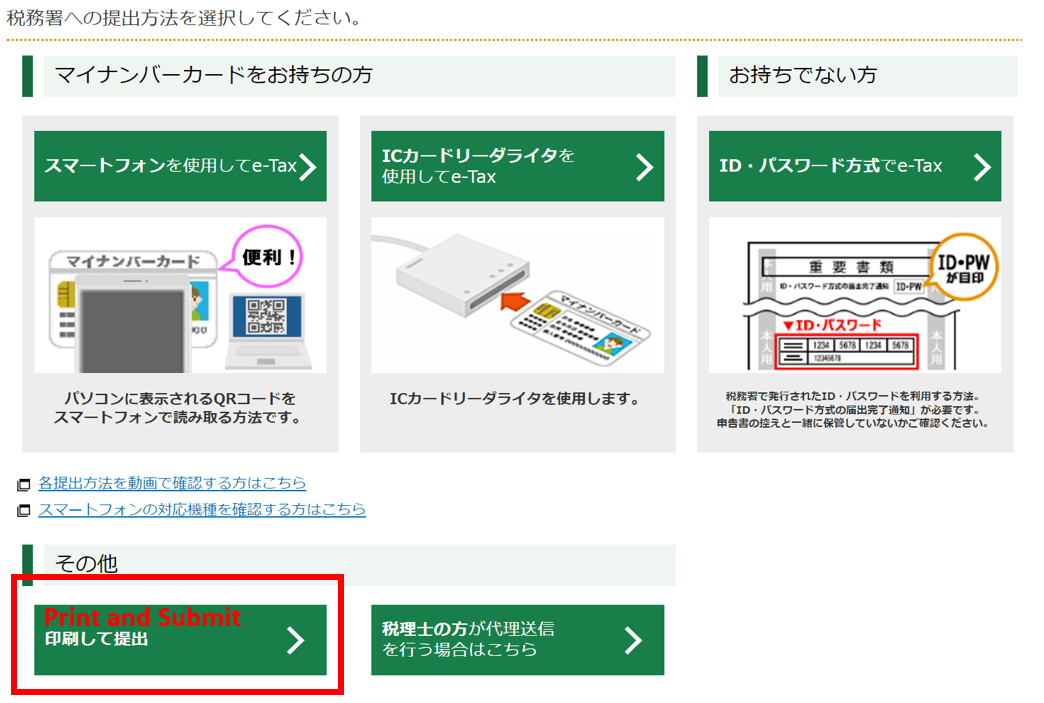

On the first screen after clicking "Start Creation/作成開始", you are asked to select how you plan to submit your tax return.

5 different submission methods are displayed on the screen.

The top two on the left are the electronic submission methods that use My Number Card (Individual Number Card). This is only applicable if you have My Number Card.

The top right is the electronic submission method for those without My Number Card. But this method requires you to have your ID and password issued at the tax office in advance.

Regardless of which method is chosen, there is no significant difference in the document creation procedure. So in this guide, we will explain the most versatile "Print and Submit/印刷して提出" method.

In this "Print and Submit/印刷して提出" method, after you create the tax return, you will need to submit it either by posting it or physically bringing it to the tax office. The method of filing the tax return using a smartphone is also explained separately, however, it uses My Number Card and it can be troublesome. In the scenario that it does not work, you can use this "Print and Submit/印刷して提出" method as a good fallback.

Another advantage of submitting the physical printed version is that you have the option of providing the ledger output report from Cryptact as a supporting document.(*)

(*)We understand that you are not required to attach any documents for miscellaneous income, however, you can choose to attach one to show how the PNL was calculated for cryptocurrency trading.

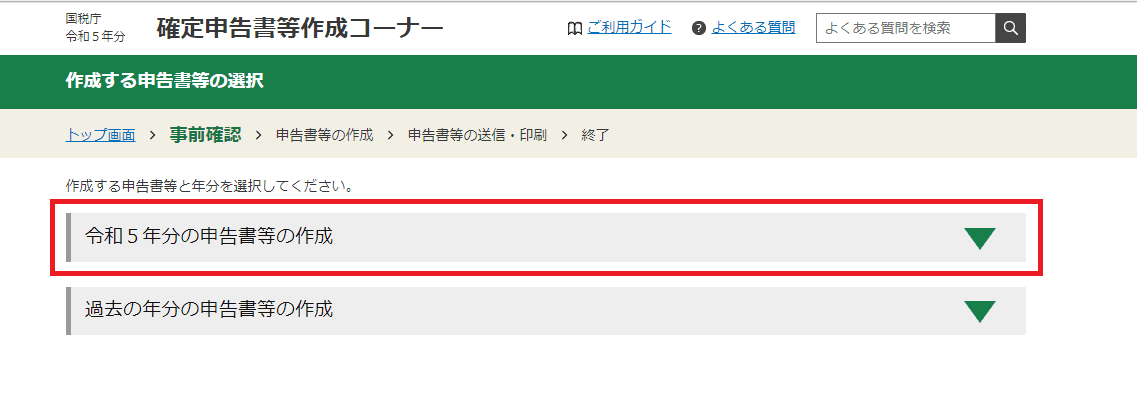

After checking the recommended environment and terms of use, click "Accept Terms and Conditions and proceed/利用規約に同意して次へ". On the next page, you select which year you are creating a tax return for.

If you are creating a tax return for 2023, select "Create Tax Return for 2023/令和5年分の申告書等の作成". If you are creating a tax return for earlier years, select "Create Tax Return for Earlier Years/過去の年分の申告書等の作成".

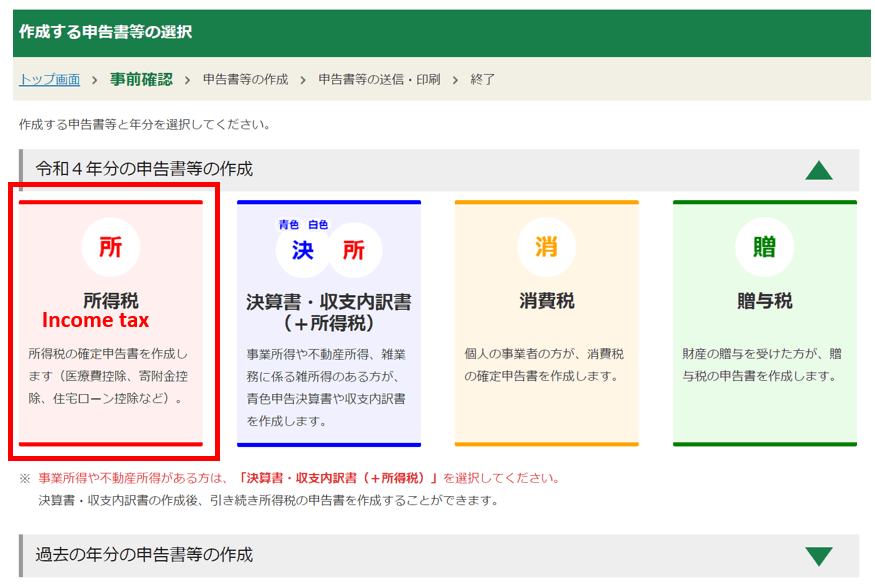

The next screen is the "Select the tax return form/作成する申告書等の選択" screen.

It allows you to select which tax you are creating the tax return for. In this example, the tax return is for miscellaneous income from cryptocurrency trading, so select "Income tax/所得税" on the far left.

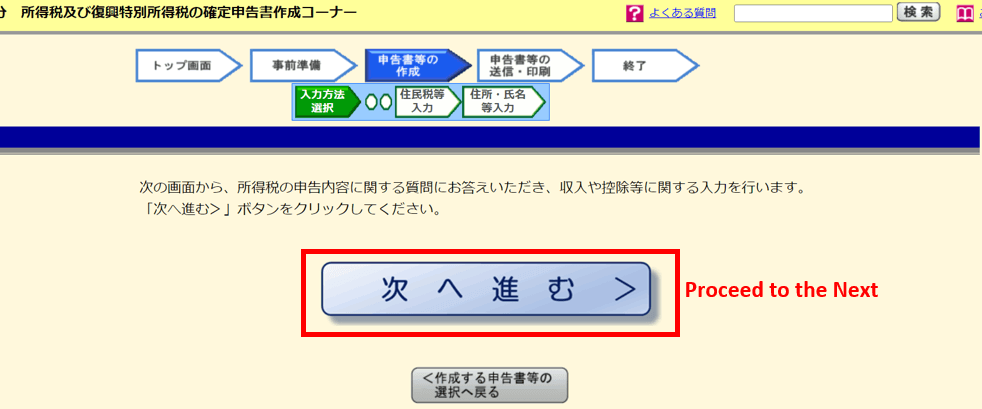

Click "Proceed to the Next/次へ進む" on the next screen.

Step 3. Enter basic information

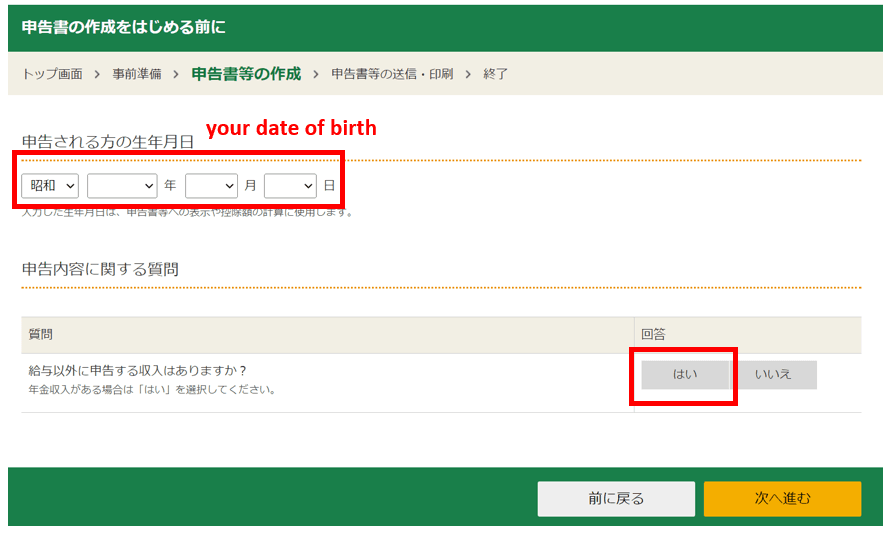

The "Before creating a tax return/申告書の作成をはじめる前に" screen is the first place you start entering your data.

First, you enter your date of birth.

Then, you will be asked questions about the details of your declaration.

The purpose is to declare miscellaneous income, so please select "Yes/はい" to "Do you have any income to declare other than your salary?/給与以外に申告する収入はありますか?".

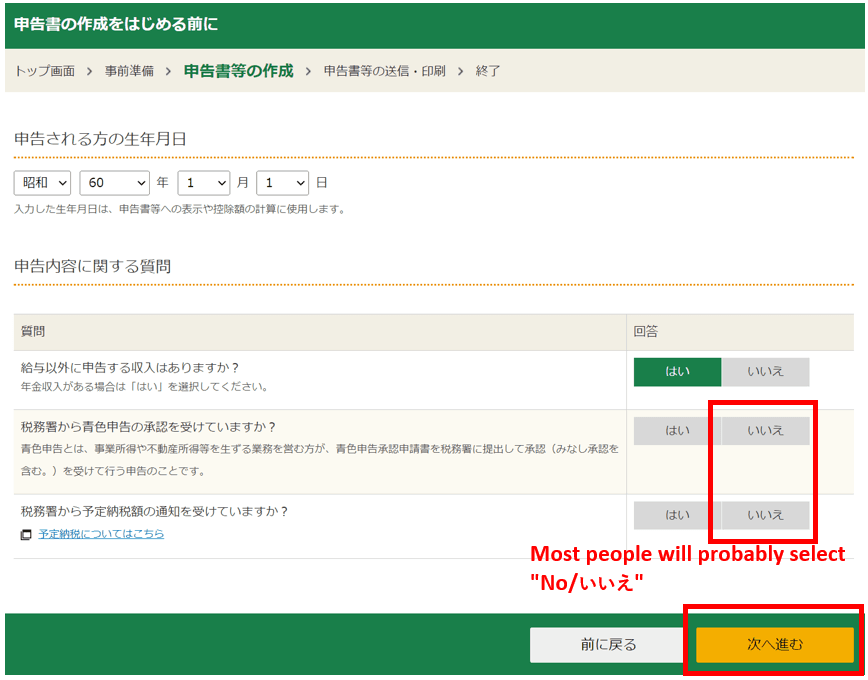

Then, you will be asked two additional questions.

The first question is "Have you received approval from the tax office to file a blue tax return?/税務署から青色申告の承認を受けていますか?".

Blue tax returns are basically for those with business income. Most people will probably select "No/いいえ", as it is seldom that cryptocurrency income is considered a business income.

The next question is “Have you been notified of the estimated tax payment amount by the tax office?/税務署から予定納税額の通知を受けていますか?".

In some cases, taxpayers who meet certain requirements, such as having paid a large amount of tax in the previous year, are asked by the tax office to pay income tax in advance on their anticipated income. This is known as the scheduled tax payment.

If it does not apply to you, select "No/いいえ".

Click "Next/次へ進む" and go to the next screen "Enter income amount/収入金額・所得金額の入力".

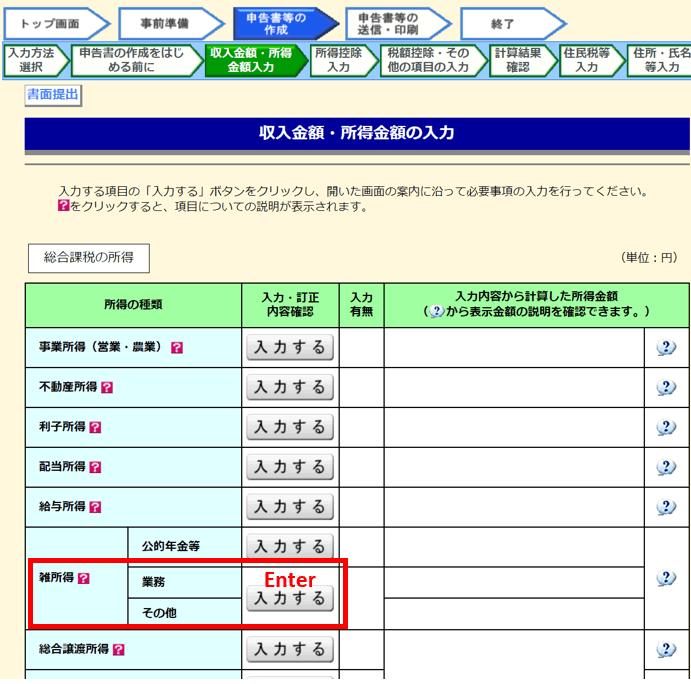

Step 4. Declare income from cryptocurrency trading

Finally, you enter income from cryptocurrency trading here.

Find the "Miscellaneous Income/雑所得", click "Enter/入力する" for the "Other/その他" category.

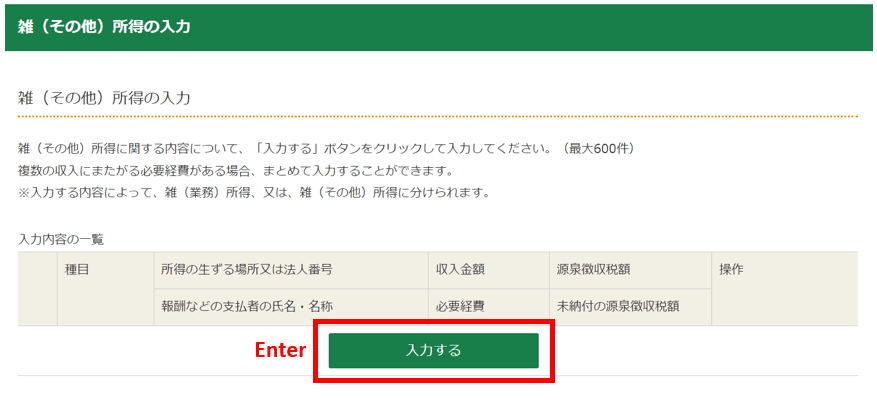

The below screen appears. Click "Enter/入力する" again.

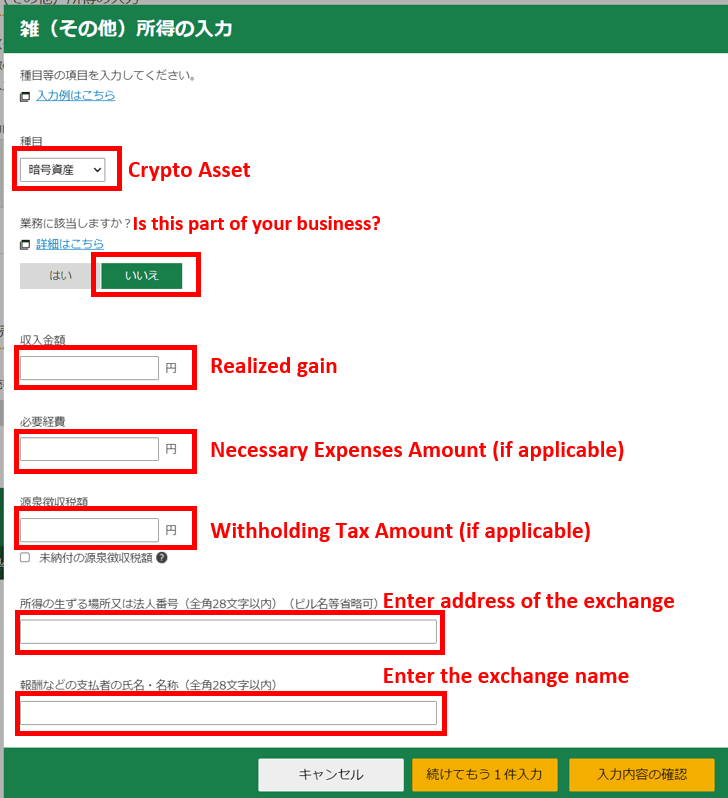

Then the data entry screen pops up.

This workflow of clicking "Enter/入力する" and the data entry screen popping up is common to other items as well. It is intuitive and easy to understand.

In the popup screen, enter the PNL calculation result from Cryptact.

- Type/種目: Select "Crypto Asset/暗号資産". You will then be asked "Is this part of your business?/業務に該当しますか". If cryptocurrency trading is not part of your business activity, then select "No/いいえ".

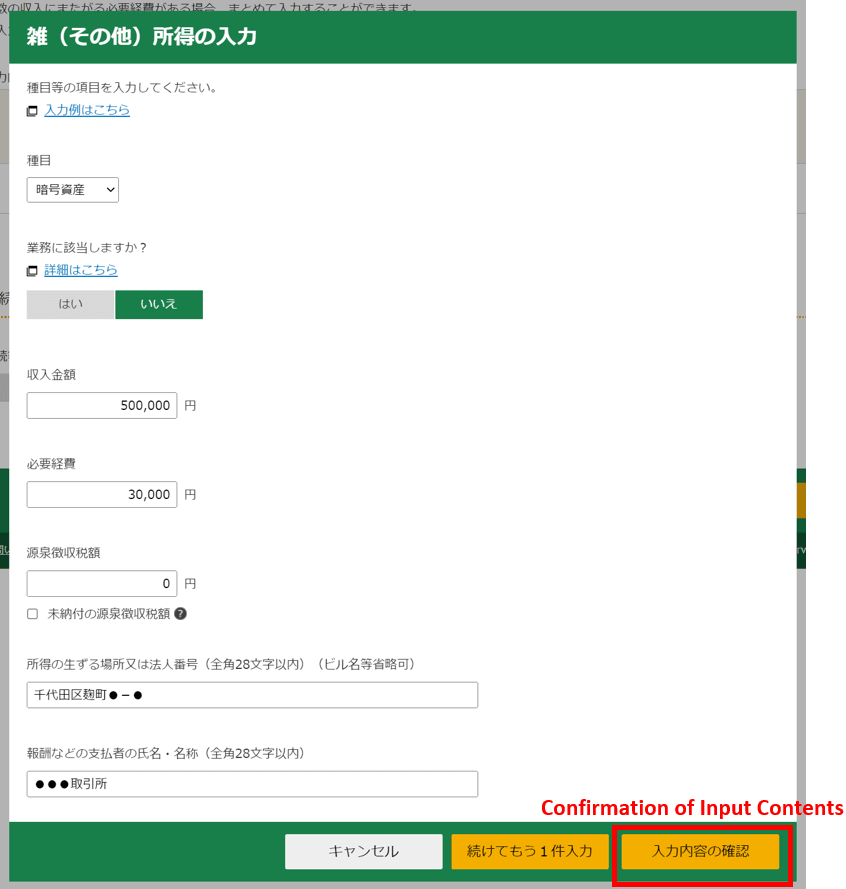

- Income Amount/収入金額: Enter the "Realized Gains/Losses/実現損益額" calculated by Cryptact if it is positive. In this example, we enter 500,000 JPY.

- Necessary Expenses Amount/必要経費: Enter any necessary expenses not accounted for in Cryptact. Any expenses that you have uploaded to Cryptact are already reflected in the realized gains/losses, therefore, no need to enter them here. In this example, we enter 30,000 JPY as the necessary expenses.

* In the realized gains/losses displayed in Cryptact, the purchase cost for the cryptocurrency and the fees for buying and selling have already been deducted as expenses. Please check with your tax adviser or your local tax office if you can record these as expenses. - Withholding Tax Amount/源泉徴収額: Enter the withholding tax amount if applicable, otherwise enter 0 JPY. Withholding tax is seldom withheld for cryptocurrency trading.

- Place or Legal Entity # where the income arise/所得の生ずる場所又は法人番号: Enter the address of the exchange, etc.

- Name of the reward payer/報酬などの支払者の氏名・名称: Enter the name of the exchange.

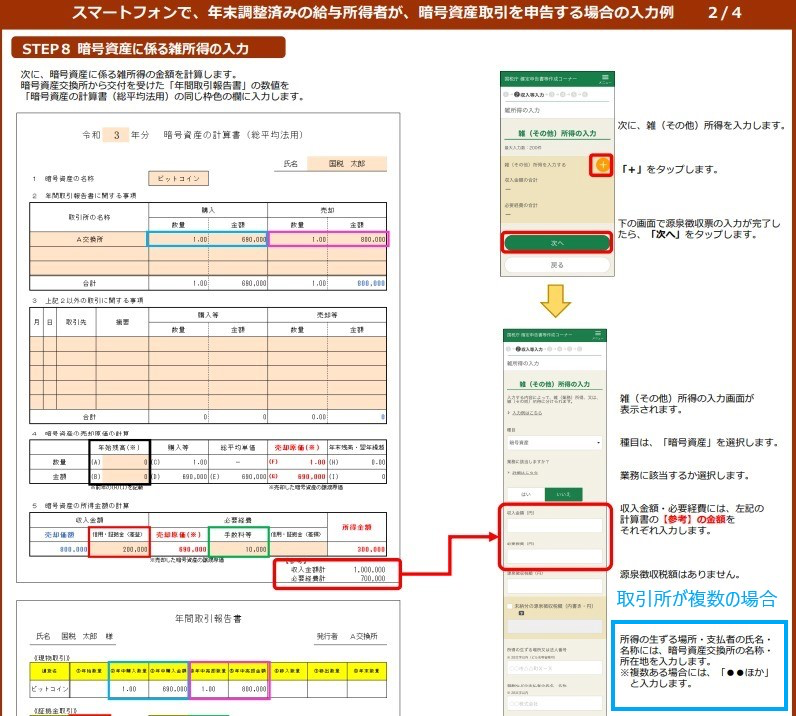

Many people often ask "If I use more than one exchange, do I need to enter the information for each exchange?" or "What if I have too many exchanges to enter?". According to the NTA's website, if you use more than one exchange, you should enter "XX and others" (see the blue box in the picture below).。

(Source: NTA's homepage "Guidelines on filing tax returns from smartphones 2021" - "Example for declaring crypto asset income/暗号資産取引を申告する場合の入力例")

For cryptocurrency trading, assets often move between exchanges and wallets. Cryptact's pnl calculation logic is not performed on an exchange-by-exchange basis. Instead, it is calculated holistically after collecting all transaction histories.

For income declaration, you should enter the realized gains and expenses calculated by Cryptact. If you trade on multiple exchanges, enter the name and the location of your main exchange and add "other" at the end.

PNL calculation for cryptocurrency trading requires a lot of effort, but in the end, you just need one figure for the income and another one for the expense.

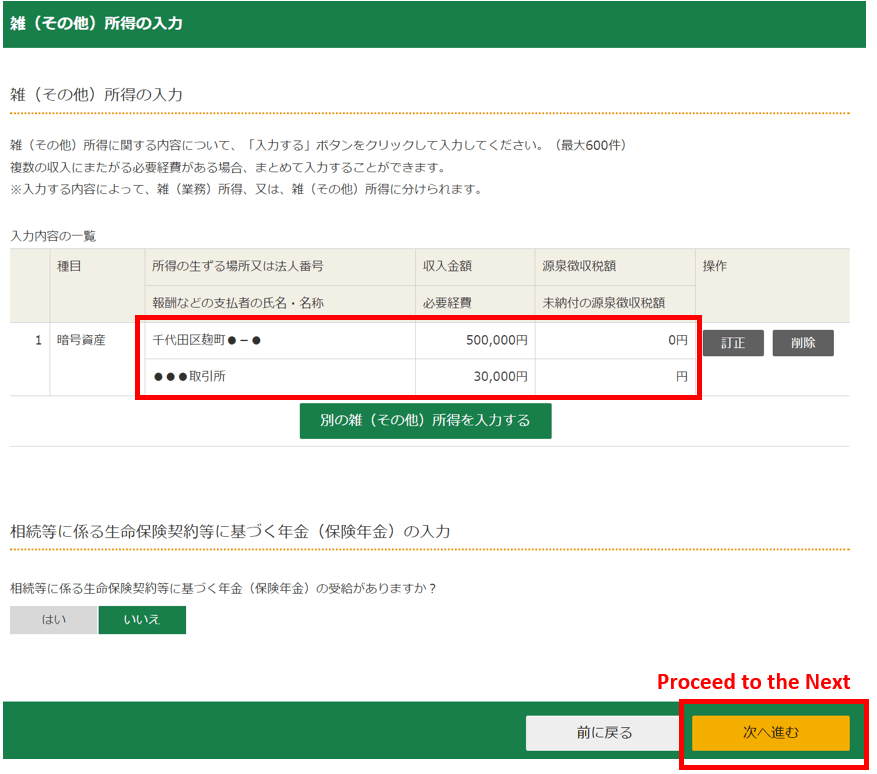

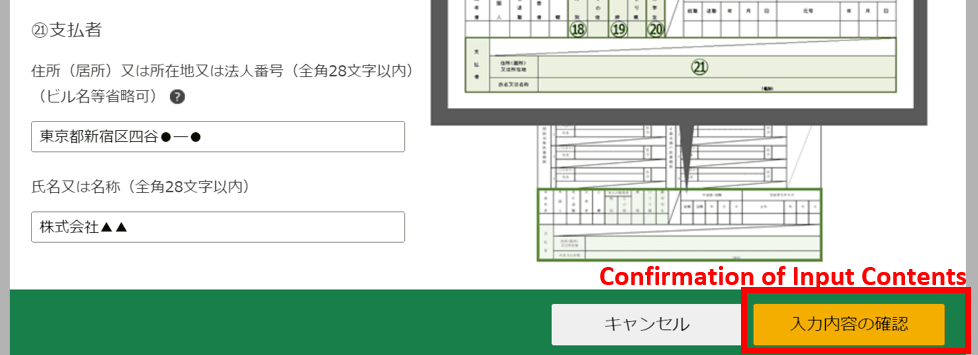

After you have entered all the data, click "Confirmation of Input Contents/入力内容の確認. You can check what you have entered.

Check the information displayed agree with Cryptact's calculation result and click "Proceed to the Next/次へ進む".

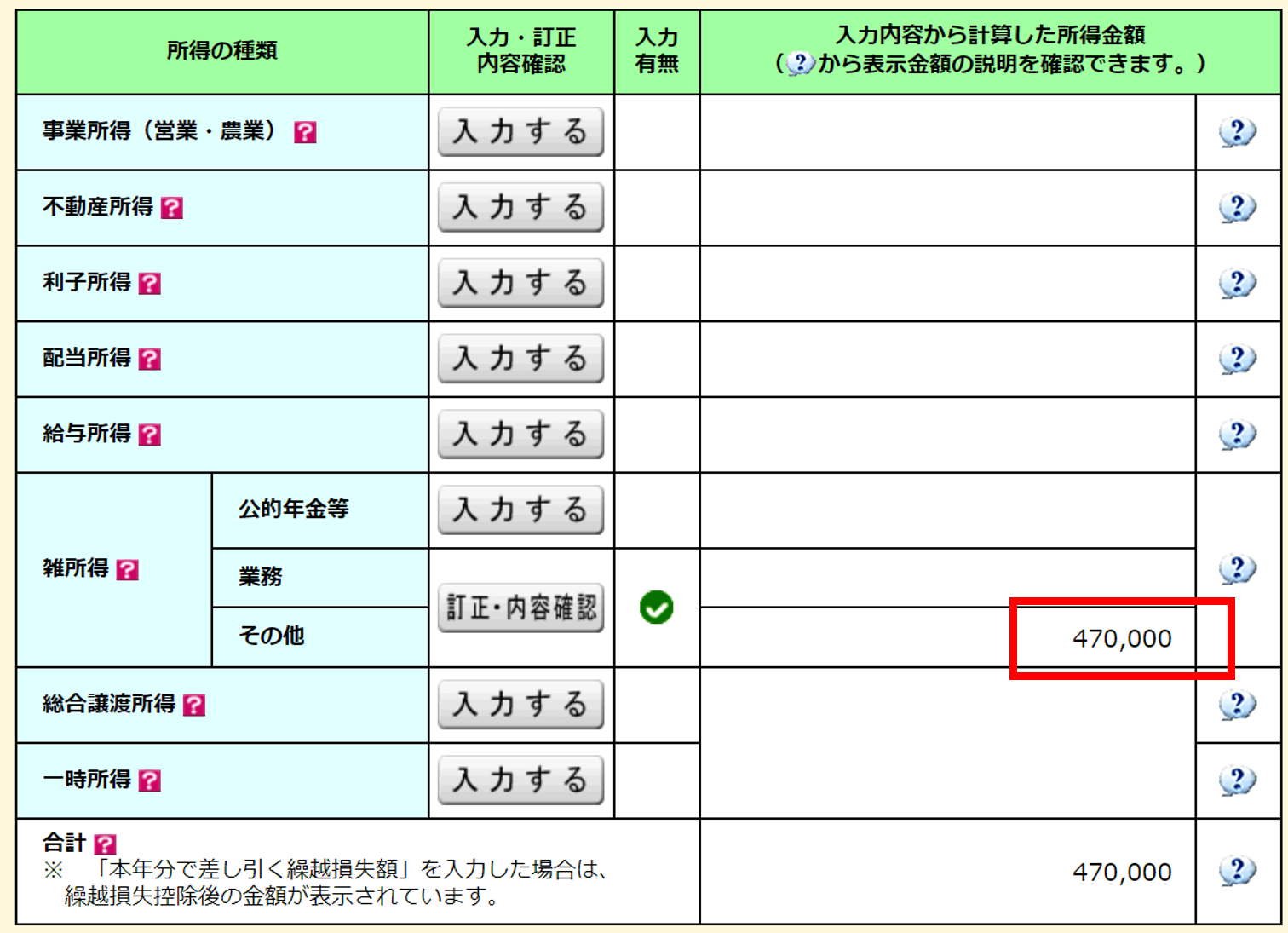

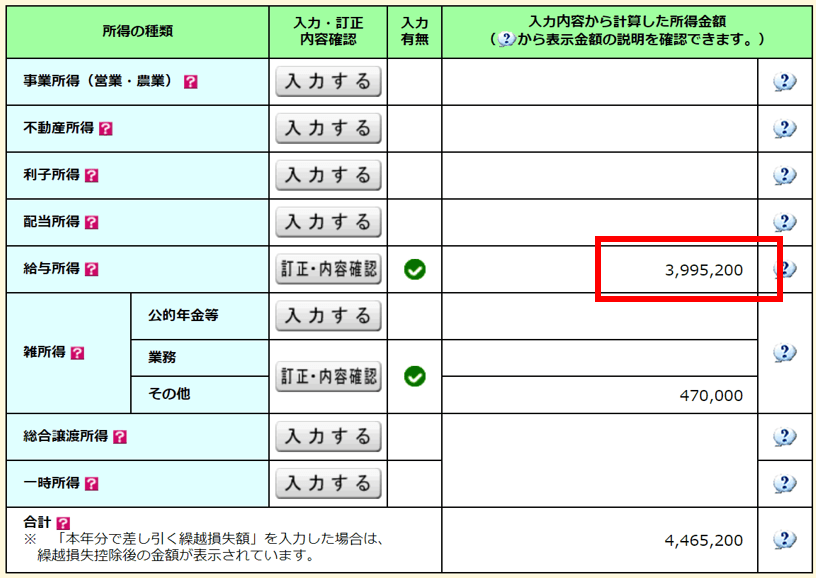

You will be redirected back to the "Enter income amount/収入金額・所得金額の入力" screen.

You will see that the amount of income you have just entered is displayed in the "Other/その他" category of miscellaneous income/雑所得. (In this example, 500,000 JPY - 30,000 JPY = 470,000 JPY is shown).

This is it for entering the income for cryptocurrency trading.

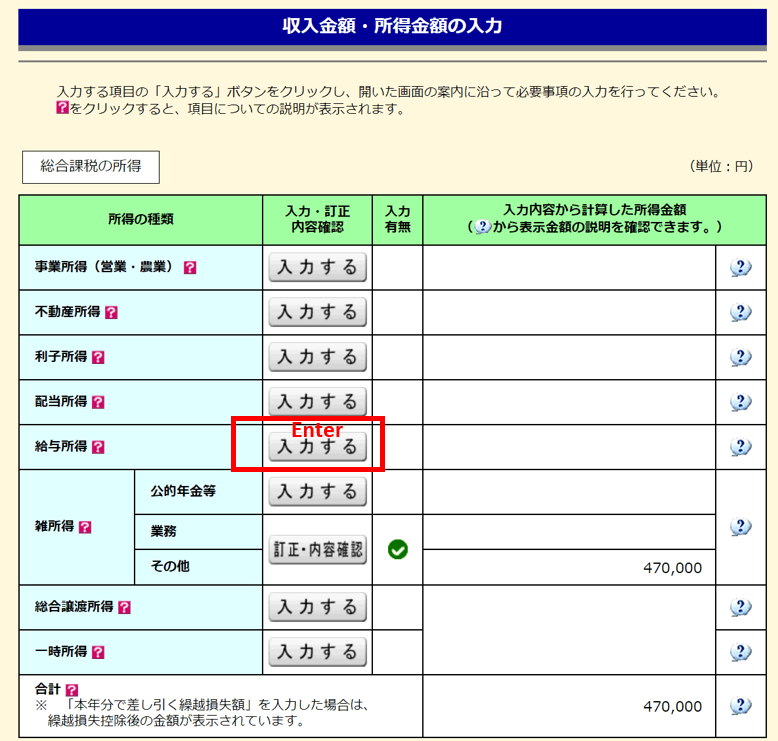

Step 5. Enter salary income

Next, enter your salary income.

Click "Enter/入力する" to the right of "Salary Income/給与所得".

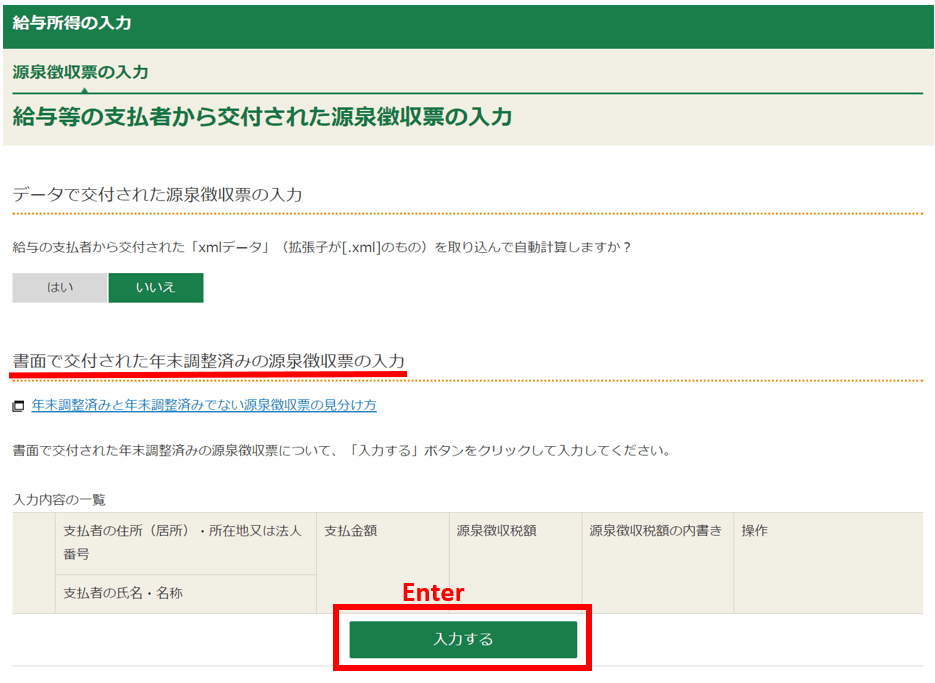

The Enter Salary Income screen appears.

If you have an electronic Withholding Tax Slip (with a .xml extension), the data can be imported and automatically calculated.

If you have Withholding Tax Slip in a paper or PDF file format, click "Enter/入力する".

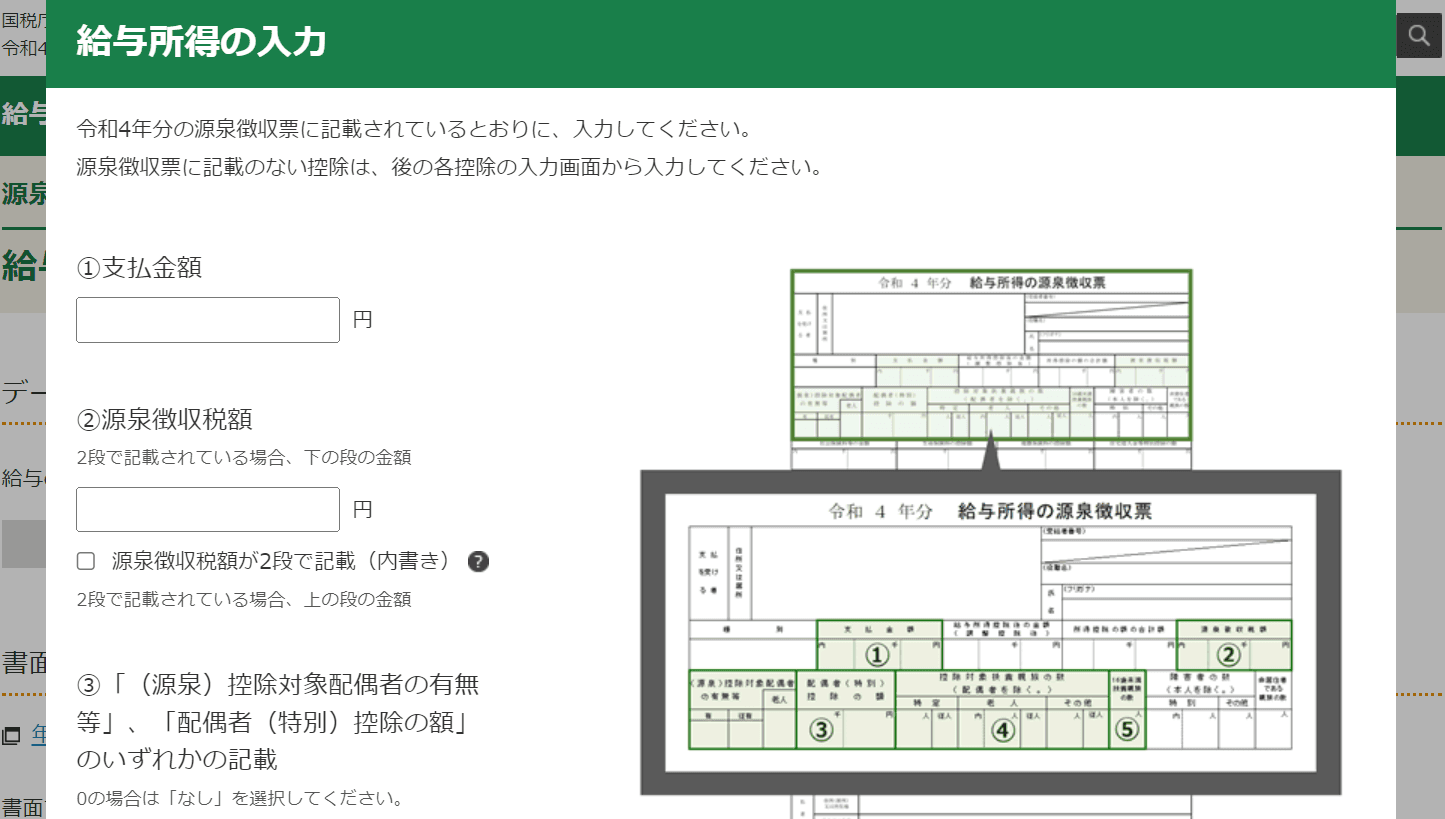

The "Enter Salary Income/給与所得の入力" screen pops up. A sample Withholding Tax Slip is also displayed.

Simply enter the information on the withholding tax slip into the screen one by one.

First, enter ①Payment Amount/支払金額 and ②Withholding Tax Amount/源泉徴収税額. The salary amount is the total amount of salary etc. paid and the withholding tax amount is the amount of tax paid after the year-end adjustment. Look at the sample withholding tax slip on the screen and see where ① and ② can be found on your Withholding Tax Slip. Enter these values.

Next, enter information on your spouse, dependants, etc which correspond to ③④⑤ on the sample slip.

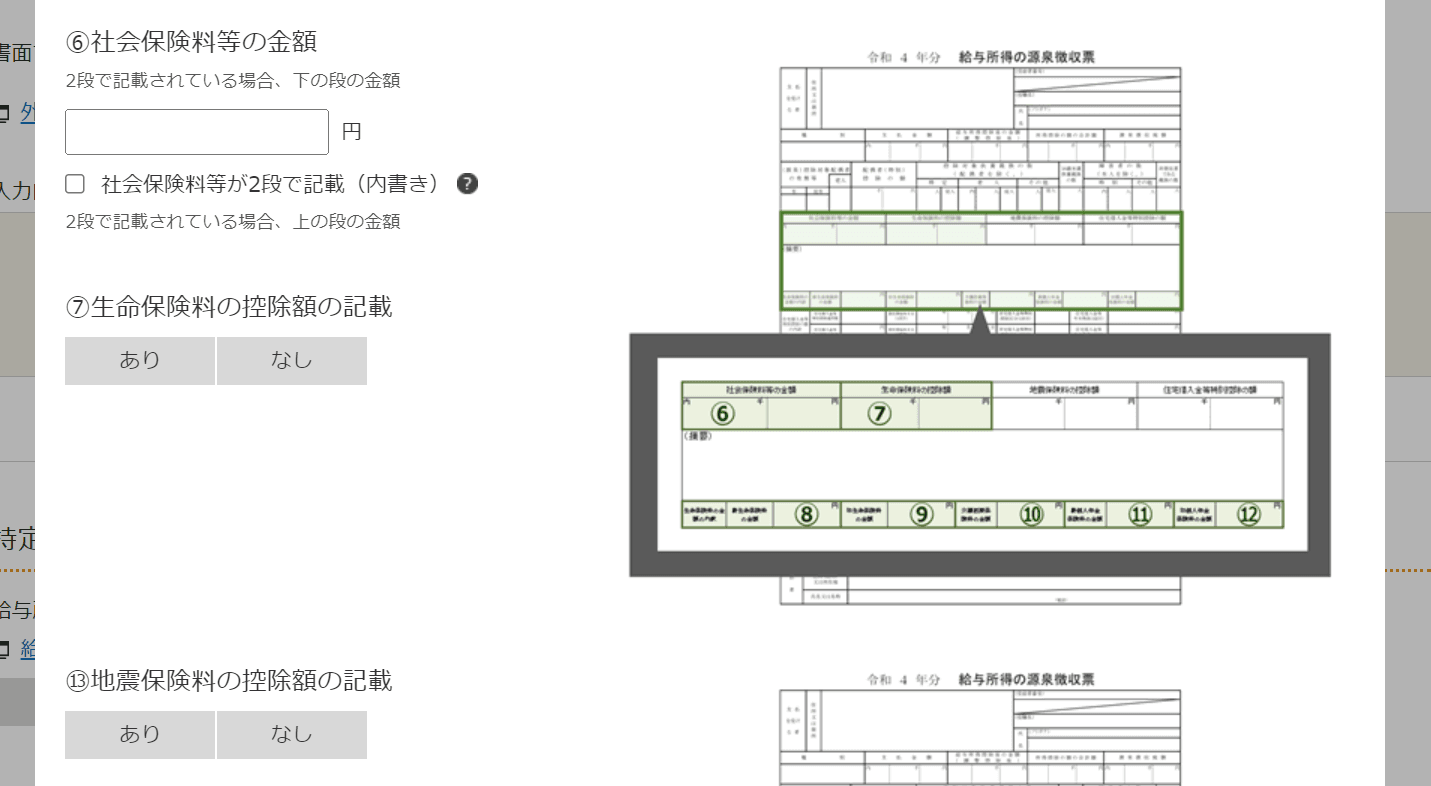

Then enter ⑥Social Insurance Premiums, ⑦Life Insurance Premiums、⑬Earthquake Insurance Premiums.

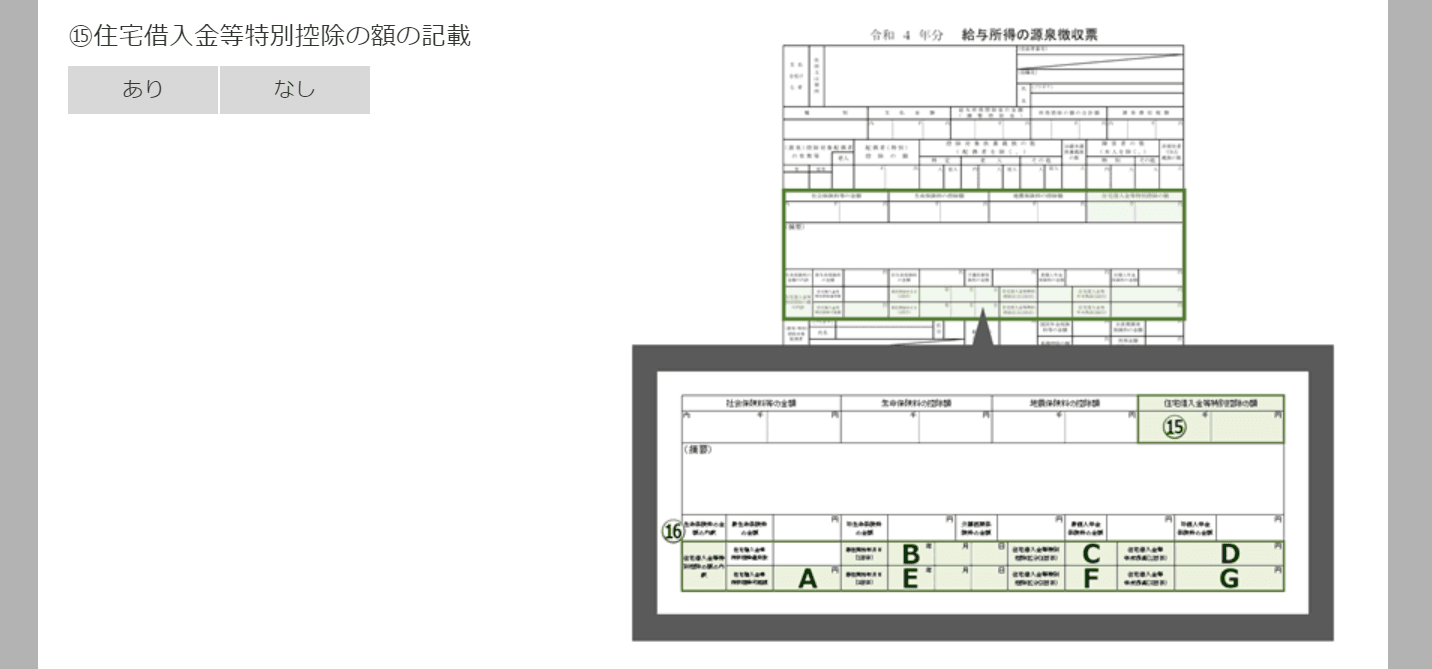

After entering the insurance premiums, then enter ⑮housing loan-related data (if applicable).

Enter ⑱-㉑ in a similar way.

The information you provided at the time of the year-end adjustment should be reflected in the withholding tax slip, so you can simply copy the values from it. If you have not provided the data for some items, you need to enter them individually.

After you have entered all the data, click "Confirmation of Input Contents/入力内容の確認. You can check what you have entered. Check the input contents and click "Proceed to the Next/次へ進む".

You will be redirected back to the "Enter income amount/収入金額・所得金額の入力" screen. You will see that the amounts you have just entered reflected in the "Salary Income/給与所得".

This is it for entering the salary income.

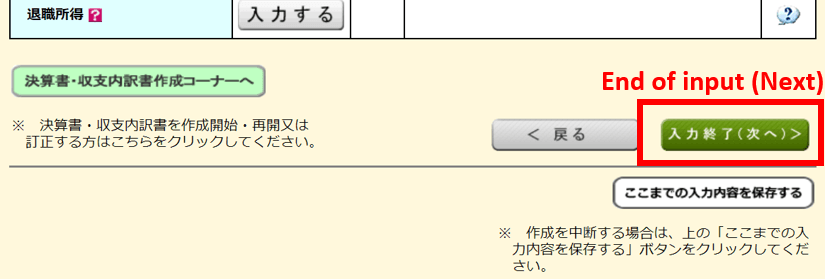

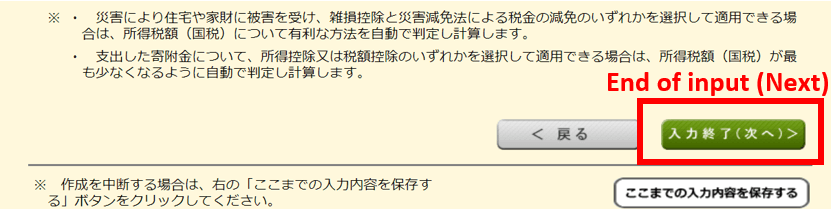

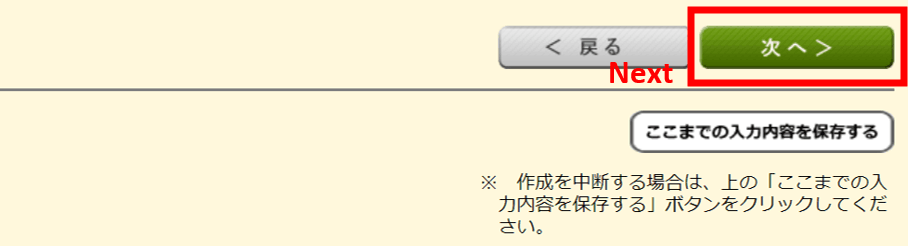

Click "End of input (Next)/入力終了(次へ)" at the very bottom of the page.

Step 6. Enter deductions

Next, you enter deductions.

The deduction items that you have already entered using the data from withholding tax slip (e.g. social insurance premium, etc) should already be populated with values. For any additional deductions that apply to you, click "Enter/入力する" to enter values.

For example, if a medical expense deduction or hometown tax deduction applies to you, you need to enter the data.

Here, we explain how to enter data for a medical expense deduction and donation deductions including hometown tax deductions.

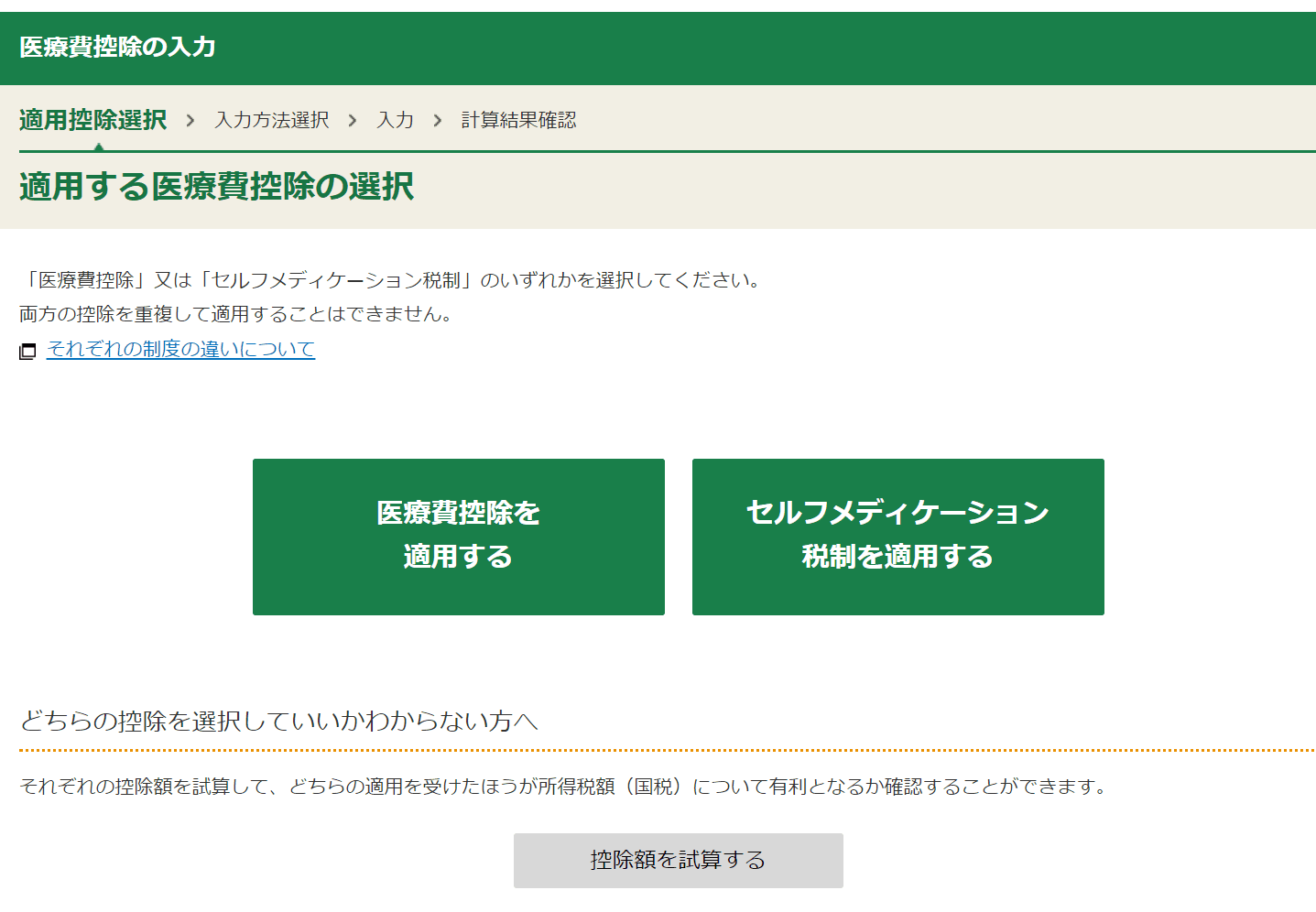

The medical expense deduction is a system that allows taxpayers to deduct from their income the amount of medical expenses actually paid to hospitals and other institutions in excess of 100,000 JPY during the year from January to December. Medical expenses include the cost of purchasing medicines, and also those paid for the dependants. Enter the medical expenses you have spent during the year, looking at receipts and other documents.

Even if you do not qualify for a medical expense deduction, if the amount of money you spent on certain medicines exceeds 12,000 JPY, the Self-Medication Tax System allows you to deduct the portion exceeding 12,000 JPY from your income.

You cannot apply for both the medical expense deduction and the Self-Medication Tax System. You can only apply for one or the other. Please check the details yourself.

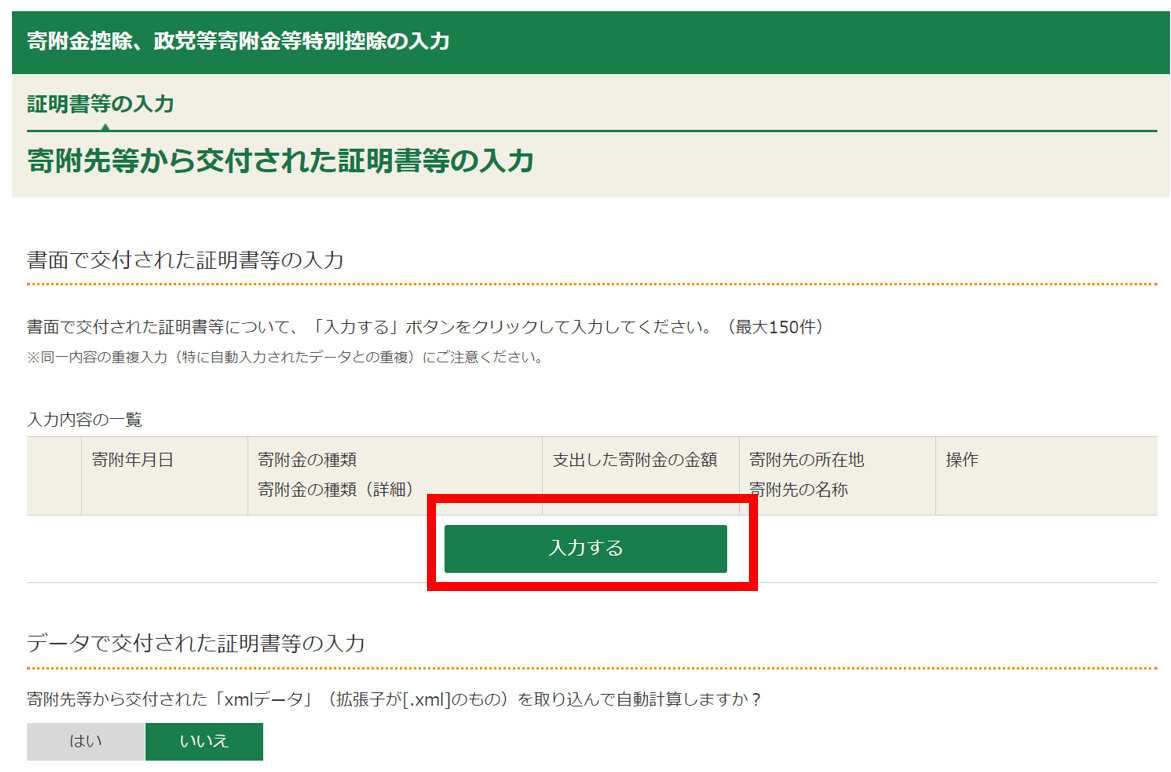

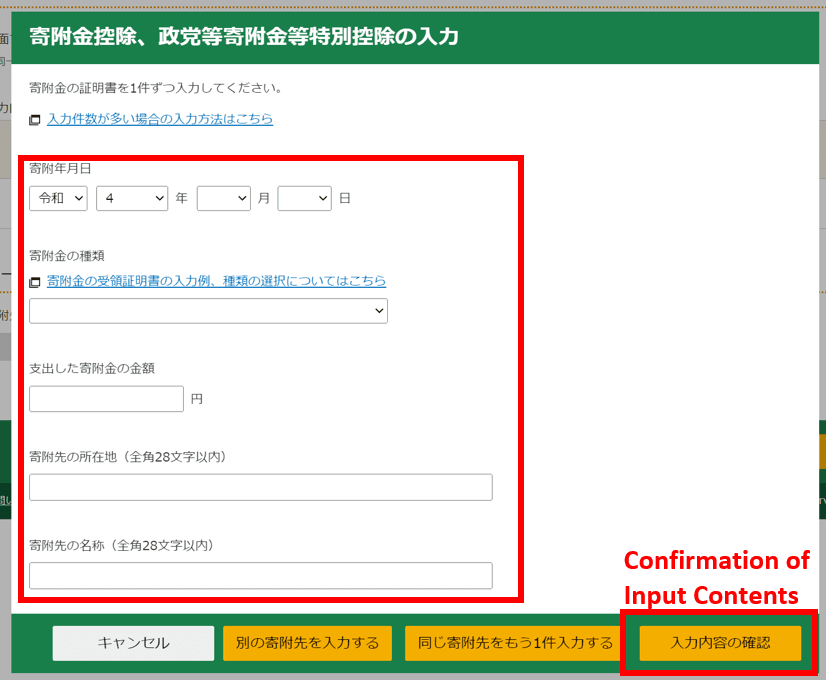

Next, we explain the donation deduction.

The hometown tax system has become very popular and many people are making donations using this system. Those who have made a donation can apply for a donation deduction here.

Donation amounts are entered per donation destination, including home town tax.

After you have entered all the data, click "Confirmation of Input Contents/入力内容の確認.

After you have entered the donation deduction, the data entry process is almost complete.

However, if you have not provided all the necessary data at the time of the year-end adjustment, or if you have not done the year-end adjustment at all, don't forget to enter the data for the spouse and dependant-related deductions as well.

After you have entered all the data, click "End of input (Next)/入力終了(次へ)" at the very bottom of the page.

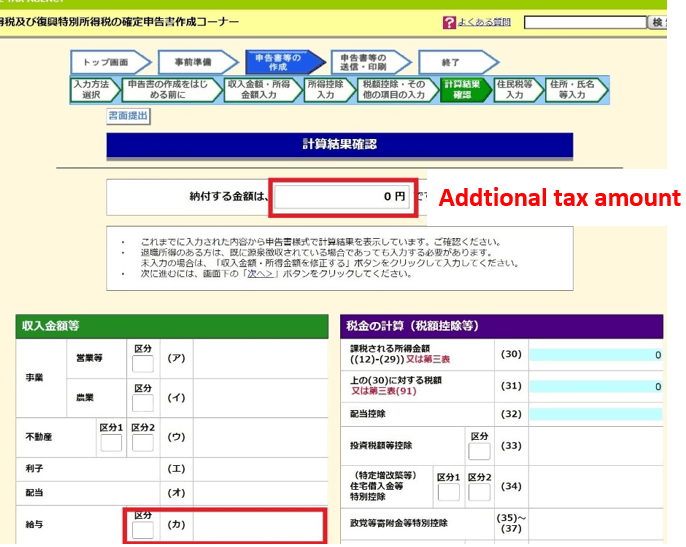

Step 7. Confirm entered data

Once you have completed entering all the data, now you confirm the entered data.

The amount displayed under "Confirm calculation results/計算結果確認" is the amount of additional tax due.

Most people reading this article will have created a tax return because of income from cryptocurrency trading, so it is likely that additional tax will incur.

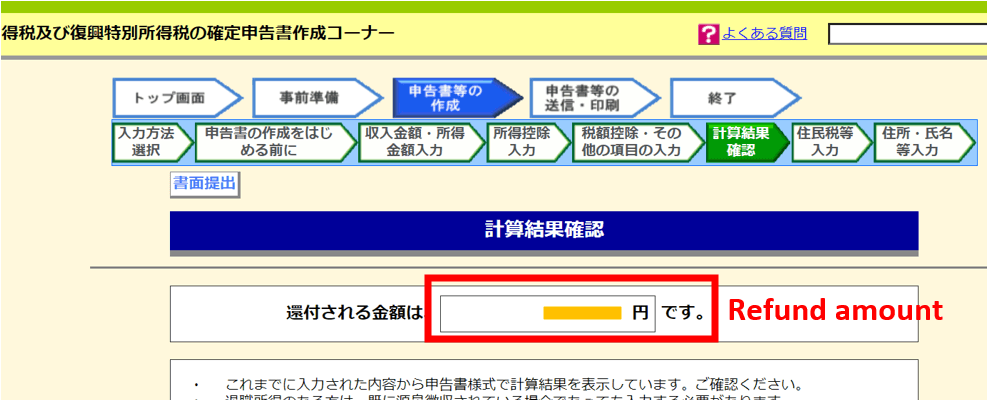

However, if the income from cryptocurrency trading is not large, there may be cases where the tax paid is refundable due to deductions for medical expenses or donations. In such cases, the refund amount will be displayed as follows.

As well as the tax amount, ensure that everything has been entered correctly, including details of salary income, the amount of miscellaneous income and income deductions.

You need to pay the additional tax due within the tax filing period.

If you wish to pay it in cash, you can fill in the amount on a payment form available at the tax office and pay at the tax office's tax payment counter. You can also pay at post offices, banks, convenience stores, etc.

The easiest way to pay tax is by automatic transfer from your bank account.

You can register your bank account in the steps that follow, the additional tax due will be deducted from your account by automatic transfer. The automatic transfer will take place approximately one month after the tax filing period.

Tax refunds will also be deposited to your bank account if you have registered your bank account.

It is important to note that even if the automatic transfer/deposit successfully takes place, this does not mean that the tax office has confirmed there are no problems with your tax filing.

It simply means that a refund or payment was processed according to your declaration. You may still receive enquiries from the tax office at a later date if there are any deficiencies or uncertainties in your tax filing.

After you have entered all the data, click "End of input (Next)/入力終了(次へ)" at the very bottom of the page.

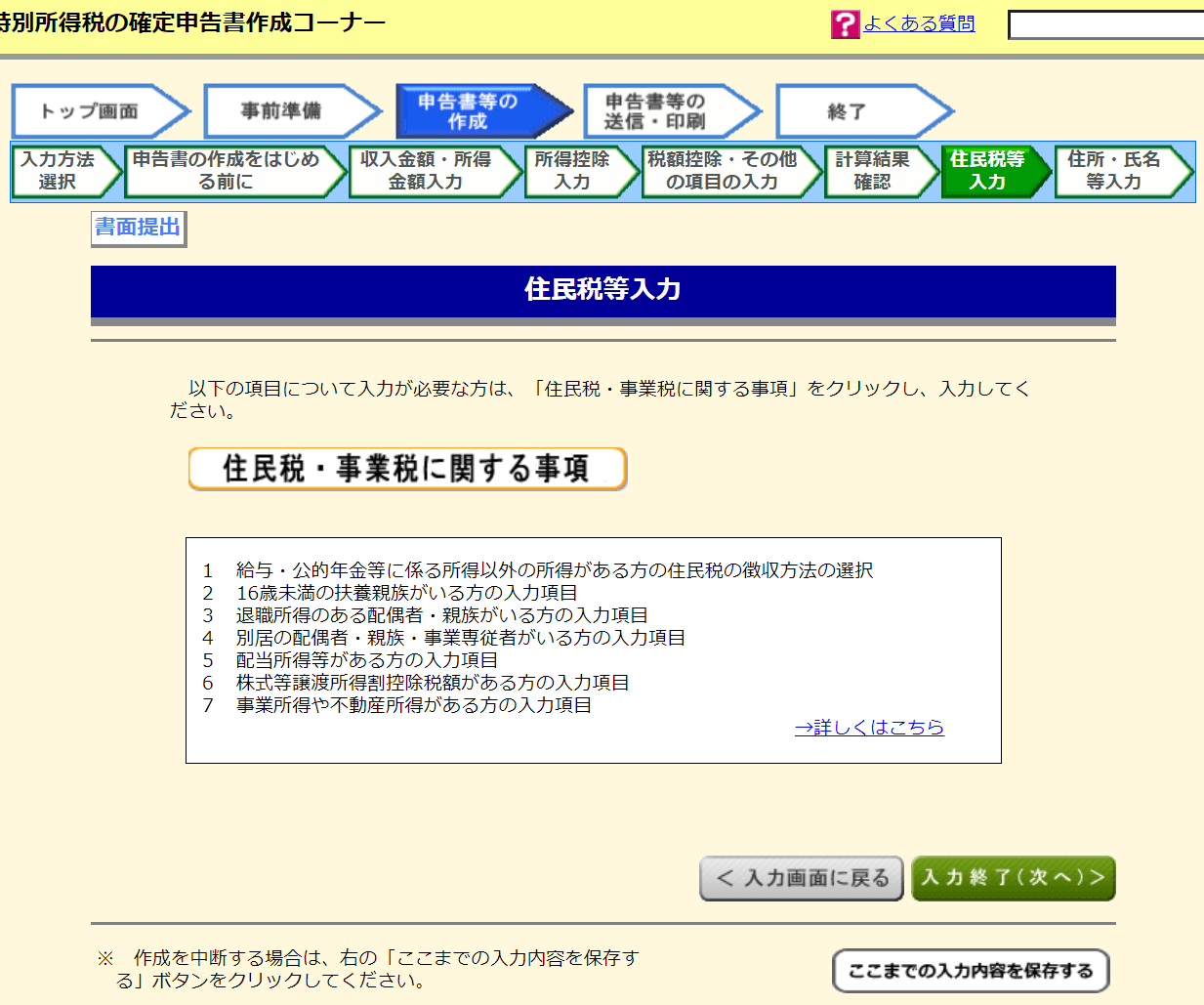

Next, you enter information related to your residential tax.

Step 8. Enter personal information

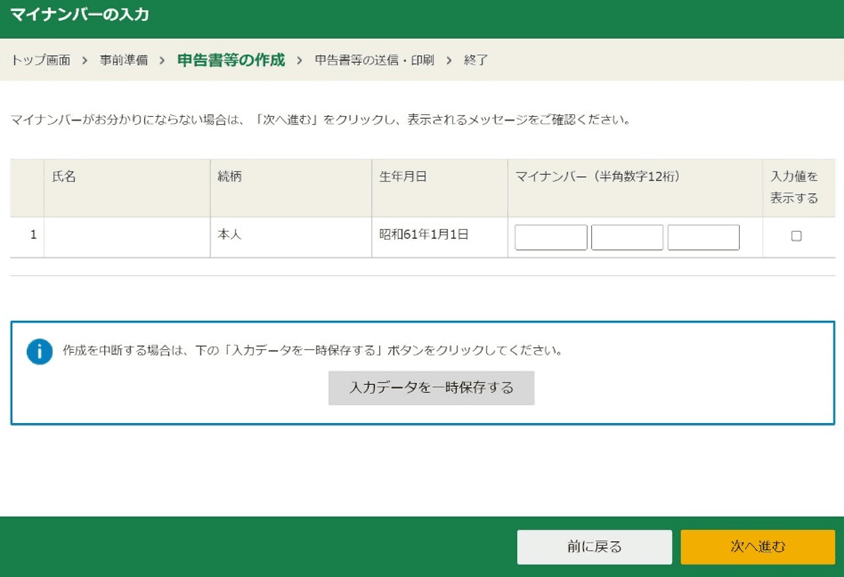

Lastly, you enter information about yourself.

Here, you enter your address, my number, your bank details, etc.

After you have entered your personal information, click "Proceed to the Next/次へ進む".

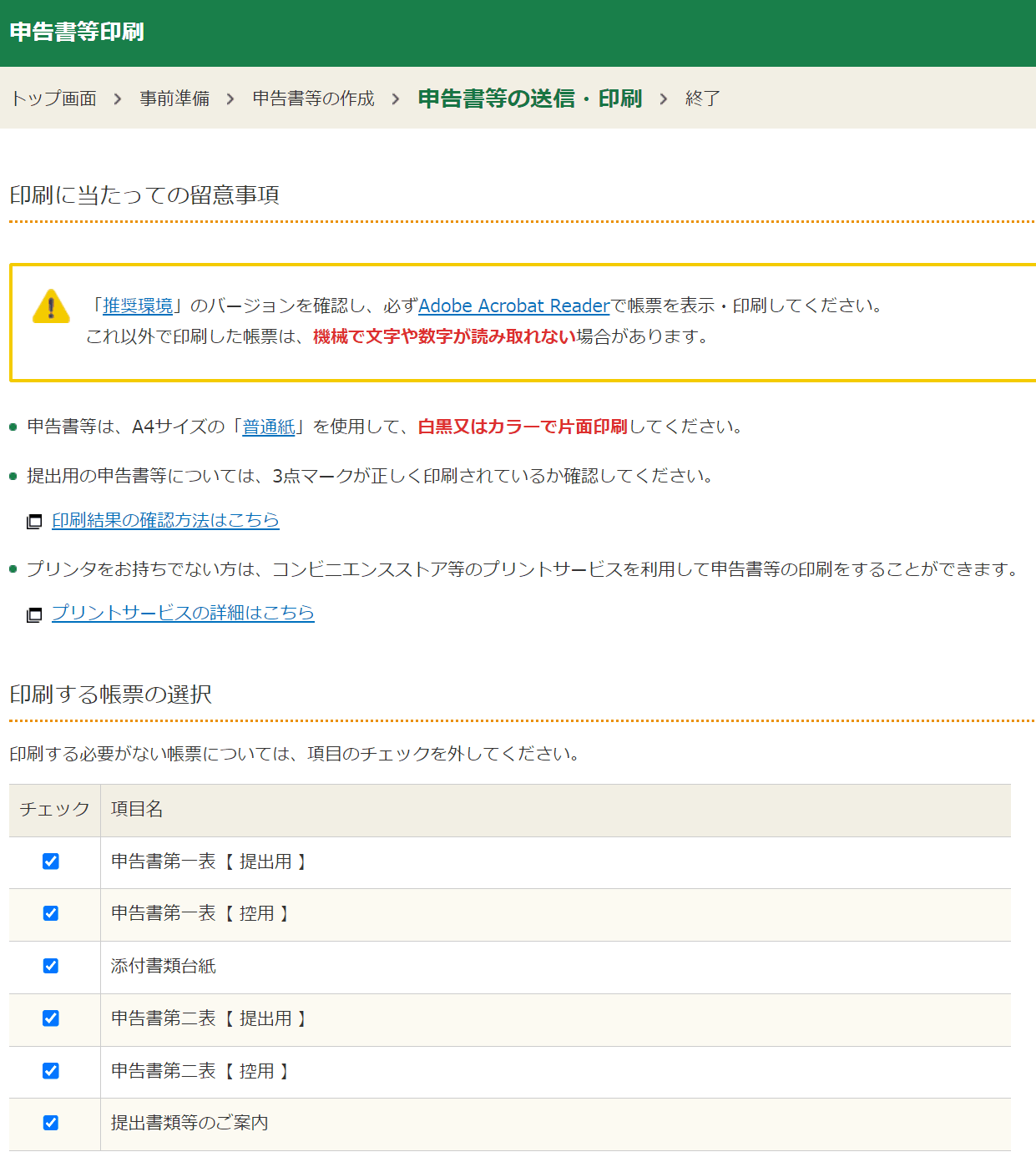

Step 9. Print the form and submit

The last steps of the tax filing process are printing and submission of the forms.

Select the forms you need to print. They will automatically be displayed on the screen. For declaring salary income and miscellaneous income, you need to submit Sheet-1/第1表 and Sheet-2/第2表 of your declaration form.

If you would like the tax office's seal of acceptance on your receipt copy, bring the copy to the tax office and they will stamp it with their seal of acceptance when you submit the form.

If you are sending the form by post, you send the submission copy.

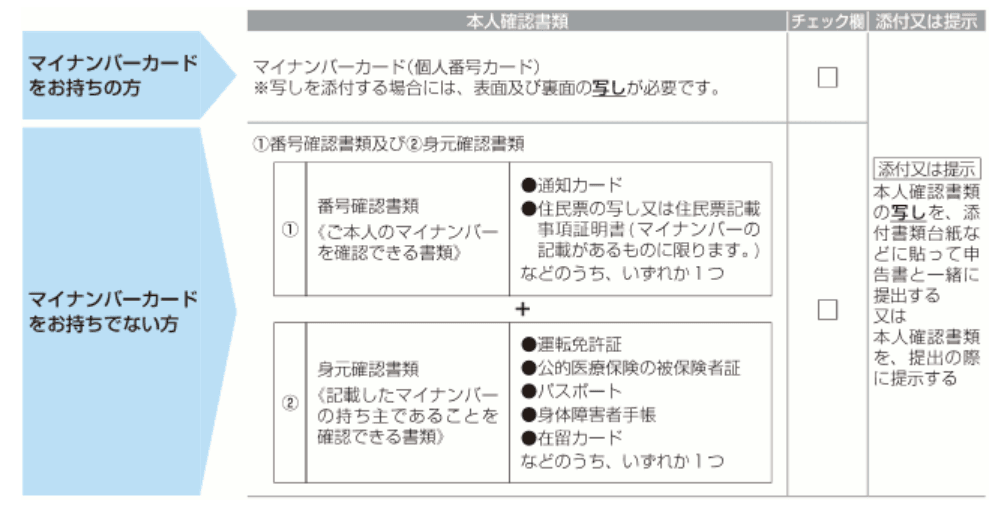

■ Required documents

A copy of the identification document must be attached in order for the tax office to verify your identify with regard to the My Number stated in Step 8.

Please check NTA's homepage for the details on the documents to be attached.

National Tax Agency "Documents to be attached/presented for tax returns/申告書に添付・提示する書類"

These are the complete steps for filing a final tax return for cryptocurrency trading.

The deadline for filing tax returns and paying additional taxes is Wednesday 15 March. Don't forget to complete the process in time.

Please also refer to the below.

Final Tax Return for Cryptocurrency trading made easy!

In order to file a tax return for cryptocurrency trading, it is obviously necessary to calculate the realized profit to be included in the tax return. Doing this by yourself is a painstaking task.

The National Tax Agency has prepared a form for calculating the profit for cryptocurrency trading, but you may still feel uneasy about personally calculating something that you need to file as miscellaneous income in your tax return.

* Source: National Tax Agency "Information about Taxes for Cryptocurrency and Income Calculation Form (Japanese only)"

If you are one of these people, then we recommend using "cryptact", a PNL calculation tool for cryptocurrencies. With cryptact, you simply upload your transaction histories downloaded from your exchanges, and the PNL calculation is done automatically. You can also easily choose between the Average Cost and the Periodic Average Cost.

Advantages of using cryptact

|

![[2023] Taxes on Crypto Currency and How to File Tax Returns in Japan](https://pafin-cortex-production.s3.ap-northeast-1.amazonaws.com/small_221121_1_24c22a64be.PNG)