For Tax Accountants

Advanced crypto tax software for accountants

cryptact’s enterprise plan has become the choice of over 130 offices of professional tax accountants and certified public accountants, thanks to its powerful feature set and easy-to-use interface.

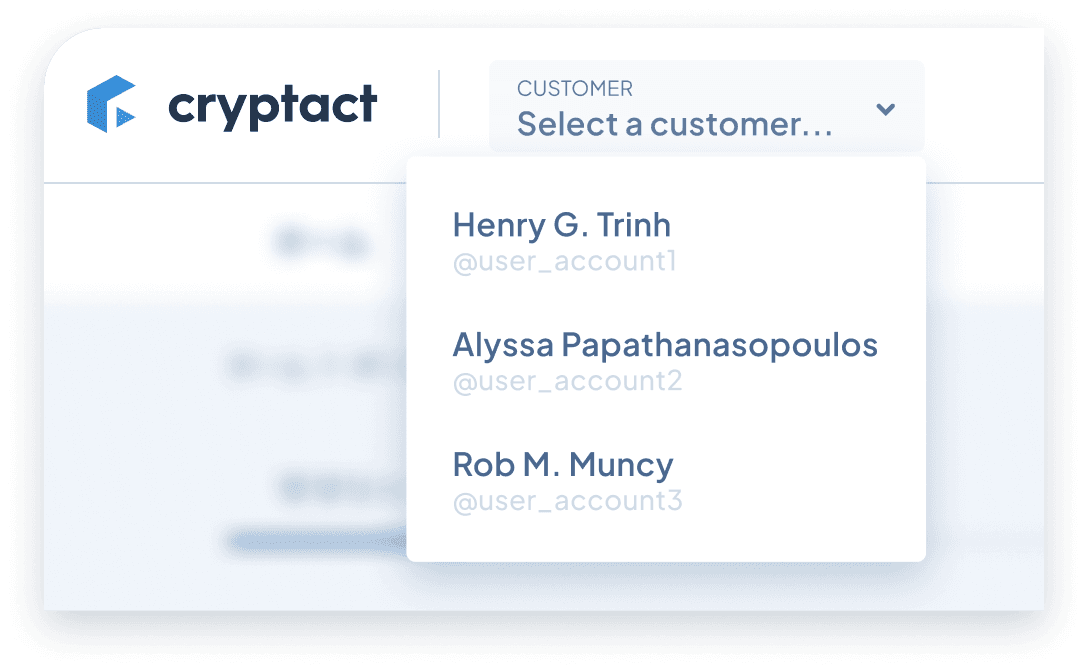

Features for accountants with multiple clients

No matter how many clients you need to manage, cryptact lets you do it all under a single account. Quickly and easily switch between different client ledgers and access their tax information at any time.

Powerful features for tax accountants

You can customize the calculations to meet each client's specific needs, including options like setting the calculation method (Average cost, Periodic average cost) and configuring corporate settings (such as the month for fiscal year-end and fiscal year-end valuation gains/losses).

Support for a wide range of transaction types

cryptact supports all your client’s potential transaction types including buy/sell, leveraged, FX, purchasing goods/services, lending, hard forks, mining, airdrops, and network fees.

Additionally, DeFi and NFT transactions can be automatically identified and calculated simply by connecting your wallet address.

Pricing

Offering the features of our highest-end Pro Unlimited plan

Unlimited transactions

Whether just a few or thousands, our automated system calculates your crypto capital gains and losses for exchanges, DeFi, and NFTs with ease.

International fiscal year-end setting

Allows you to freely change the fiscal year end for every client you add.

Email support

Our expert customer support team, well-versed in cryptocurrency, is available to promptly and carefully address any questions or concerns you may have.

Accountant

¥55,000

/year*

¥4,583/month

Transactions/year:

Accountant plan key features:

Unlimited exchanges & wallets

DeFi/NFT automated classification

- Corporate fiscal year-end setting

- Email support

Custom transactions/custom file support

Data retention

- Ledger download

Advanced ledger settings

Unlimited exchanges & wallets

DeFi/NFT automated classification

- Corporate fiscal year-end setting

- Email support

Custom transactions/custom file support

Data retention

- Ledger download

Advanced ledger settings

*Price shown includes tax. The fee of ¥55,000 is charged per client for a 12-month subscription.

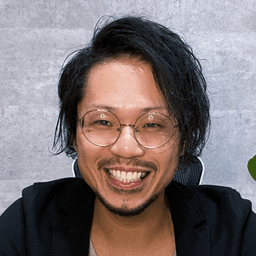

What our Enterprise clients are saying

Takuya Tanabe

COINTAXcryptact is more accurate in its calculations than any other service, and the data it outputs is easy to verify. When using a crypto calculation system, we want to make sure that the calculations are accurate and that the output data is easy to reconcile. cryptact has met these two requirements at a high level, and we have been using it since its release. In addition to the number of exchanges and currencies supported, and the ability to handle large transaction volumes, the service is being constantly updated, and I can feel that it is becoming easier and easier to use all the time. Even if you file your tax return based on the results of a calculation service, you will be responsible for any tax audit that results due to inaccurate calculations. cryptact is highly recommended because not only does it calculate according to NTA guidelines, but it also displays errors for any incorrect transactions, making it difficult to make mistakes in your tax preparation.

Keigo Sasa

REBFLEET Tax AssociatesIn addition to the number of supported exchanges the API integration and DeFi functions are very helpful. I find this service very easy to use. The service covers most exchanges in Japan, and most of the exchanges that my Japanese clients use overseas. The number of exchanges supported via API is increasing, making it easier to track profits and losses not only during the tax filing period but also in the middle of the year. This can help with making better trading decisions towards the end of the year. Also, for DeFi transactions, collecting data and calculating profit can be done simply by inputting a wallet address, which is very convenient. As the number of supported chains increases in the future, I believe that it will become even easier to handle tax returns even with DeFi transactions.