高度な取引をする

仮想通貨上級者にも対応

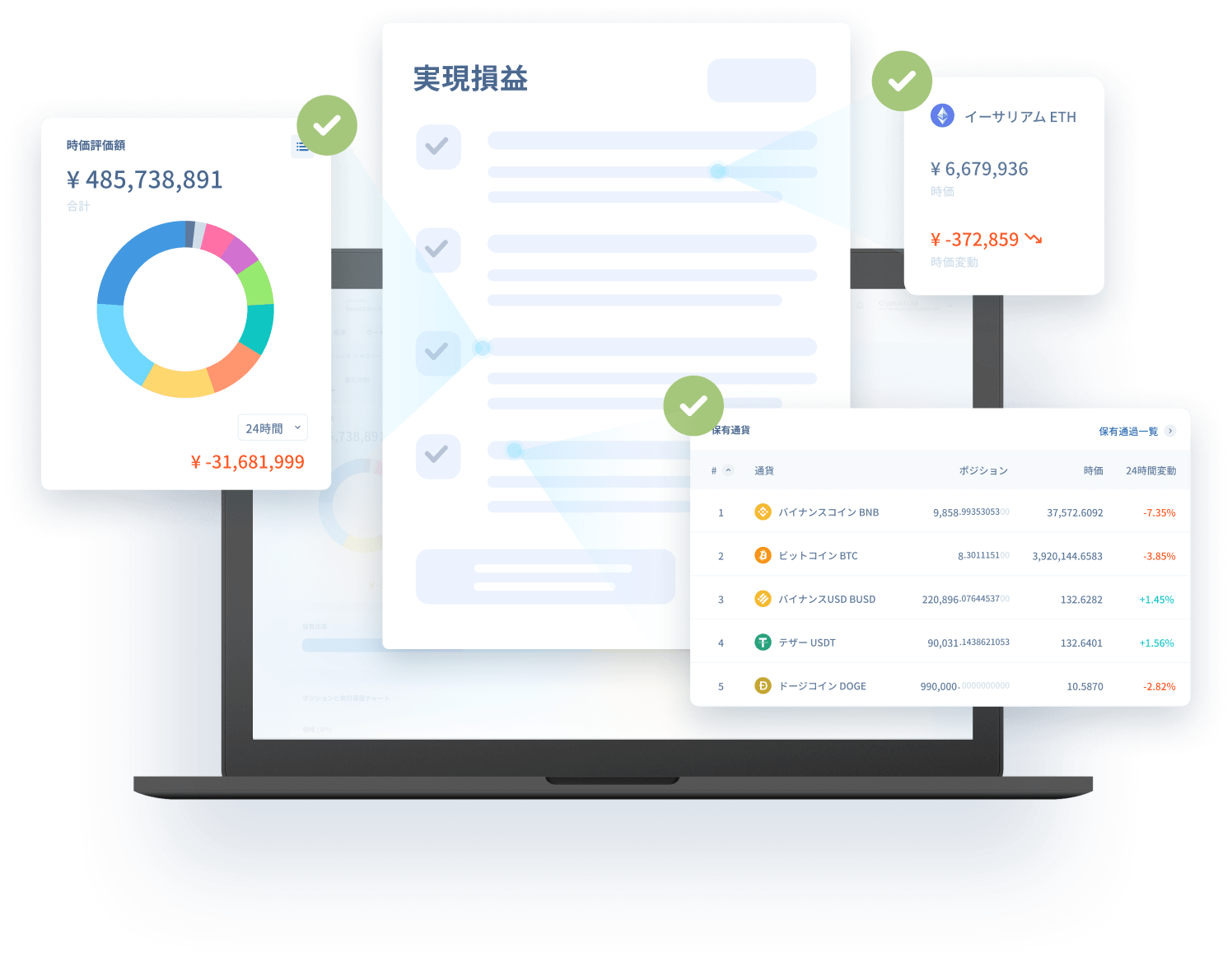

ウォレットアドレスを入力するだけで、すべての履歴を自動で取り込み。

DeFi取引の見える化。

※対応チェーン:BNB Smart Chain/Ethereum/Polygon/Fantom/Avalanche

(2022年10月時点)

ユーザーの声

シンプルなステップで、今すぐはじめましょう

仮想通貨の損益計算で必要なのはたったの3ステップ

無料アカウントに

登録

取引履歴の

準備

クリプタクトに

取引履歴をアップロード

計算完了!

料金プラン

無料プラン

- 年間取引件数50件まで

- 海外取引所の自動対応

- カスタム取引・取引編集

- カスタム取引のサブカテゴリー利用

- DeFi/NFT取引の自動対応

- 1回のファイル容量50MB

¥0

/ 年ライトプラン

- 年間取引件数5,000件まで

- 海外取引所の自動対応

- カスタム取引・取引編集

- カスタム取引のサブカテゴリー利用

- DeFi/NFT取引の自動対応

- 1回のファイル容量80MB

¥19,800

/ 年(税込)アドバンスプラン

- 年間取引件数1,000,000件まで

- 海外取引所の自動対応

- カスタム取引・取引編集

- カスタム取引のサブカテゴリー利用

- DeFi/NFT取引の自動対応

- 1回のファイル容量100MB

¥55,000

/ 年(税込)20,208

対応コイン数

122

対応取引所数

10万人以上

アクティブユーザー数

50以上

税理士ユーザー数

税理士・会計士のみなさまへ

クリプタクトの税理士・会計士向けプランをご利用いただくことで、複数のお客さまの仮想通貨の損益計算を一括管理できます。確定申告にかかる時間、労力、コストを削減するとともに、向上させることができます。

- 仮想通貨に投資をしているお客さまの確定申告サポート

- 複数のお客さまのアカウントを同時に管理

- 正確な損益を自動的に算出

- 透明性のある計算結果

税理士・会計士のみなさまの声

田辺 拓也

コインタックス税理士事務所クリプタクトはどのサービスよりも計算が正確で、出力されるデータが検算しやすいです。

仮想通貨損益計算システムを使う上で必ず満たしていて欲しいのが、行われる計算が正確な点、出力されるデータが検算しやすい点。

クリプタクトはこの2点を高水準で満たしているため、リリース当時から愛用させていただいております。

対応取引所数や対応通貨、大量な取引量に対応するなどといったアップデートも常にされていて日を追うごとに使いやすくなっていくのが実感できます。

計算システムで計算した結果にて確定申告したとしても、税務調査が入り利益額が違うと指摘された場合の責任はご自身にあります。

クリプタクトは国税庁の指針に従った方法で計算されているのはもちろんの事、おかしな取引はエラー表示されるため、計算ミスが起こりにくいので非常にオススメできます。

笹 圭吾

REBFLEET税理士事務所取引所の網羅性だけでなく、API連携機能や、DeFi機能がとても助かります。

非常に使いやすいサービスであると感じます。国内はほとんどの取引所を網羅していますし、海外についても日本である程度の知名度を持っている取引所についてはほとんど対応しています。

APIキーの連携ができる取引所も増えてきています。APIキーの連携ができる取引所が増えれば、確定申告期だけではなく、年度途中でも損益を把握しやすくなり、年末に向けてどのような運用を行っていけばよいかといった点を検討することも容易になると思います。

また、DeFi取引についても、ウォレットアドレスを接続するだけでデータ取り込みや利益計算が利用できるので便利です。

今後、対応チェーンが増えてくれば、DeFi取引を行っても確定申告対応がさらに容易になるのではと思います。